Tenant retention is one of the most crucial aspects of managing commercial real estate. While attracting new tenants is an integral part of commercial real estate, retaining existing tenants often has a more significant impact on the financial health of a property. This article explores why tenant retention matters and the financial implications of tenant turnover versus renewal.

The Financial Ramifications of Tenant Turnover

When a tenant leaves, the property owner or manager faces both direct and indirect costs. These costs can quickly add up, affecting the overall profitability of the property. Here are some of the most significant financial ramifications:

- Lost Rental Income

- Vacancy Period:

- When a tenant vacates, the property may sit empty for months or years before a new tenant is found.

- This period results in lost rental revenue, which directly impacts cash flow.

- Market Downturns:

- During periods of high vacancy or market softness, it may take longer to lease the space, prolonging revenue losses.

- Leasing Costs

- Broker Fees:

- Leasing brokers typically earn commissions for bringing in new tenants, often a percentage of the total lease value.

- Marketing Expenses:

- Advertising the vacancy requires a budget for marketing materials, listing services, and even professional staging.

- Tenant Improvement (TI) Costs

- Build-Outs:

- New tenants often negotiate for improvements to suit their specific needs, such as remodeling or custom finishes.

- These costs can be significant, especially in office or retail spaces.

- Operational Costs

- Utilities and Maintenance:

- During vacancy periods, the owner is responsible for utilities, upkeep, and any necessary repairs to maintain the property.

- Potential Rent Reductions

- Market Competition:

- To attract a new tenant, landlords may need to offer rent concessions, such as discounted rates or free rent periods, further reducing revenue.

The Advantages of Tenant Retention

Renewing an existing tenant’s lease eliminates many of the costs associated with tenant turnover. The financial benefits of tenant retention include:

- Stable Cash Flow

- Continued Revenue:

- A renewed lease ensures uninterrupted rental income, maintaining predictable cash flow.

- No Vacancy Costs:

- Retained tenants eliminate the need to cover vacancy expenses like utilities or repairs.

- Lower Operating Expenses

- No Leasing Fees:

- Renewals don’t involve extensive marketing efforts and may not require leasing commissions.

- Minimal Tenant Improvements:

- Existing tenants are less likely to require substantial build-outs compared to new tenants.

- Enhanced Property Value

- Occupancy Rates:

- Higher occupancy rates contribute to a better Net Operating Income (NOI), a key factor in property valuation.

- Market Perception:

- High retention rates signal stability to investors and potential buyers, making the property more attractive.

- Higher occupancy rates may also indicate to prospective new tenants that the building is well-run and in demand

- Strengthened Relationships

- Tenant Satisfaction:

- Happy tenants are more likely to renew, recommend the property, and collaborate on lease terms that benefit both parties.

- Reduced Disruption:

- Long-term tenants foster a sense of community and stability, improving the property’s overall environment.

Real-Life Cost Comparison: Tenant Turnover vs. Renewal

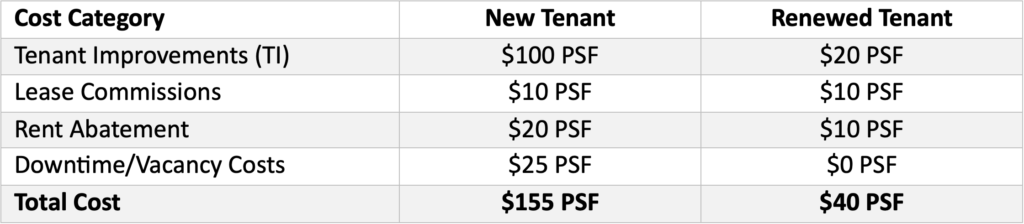

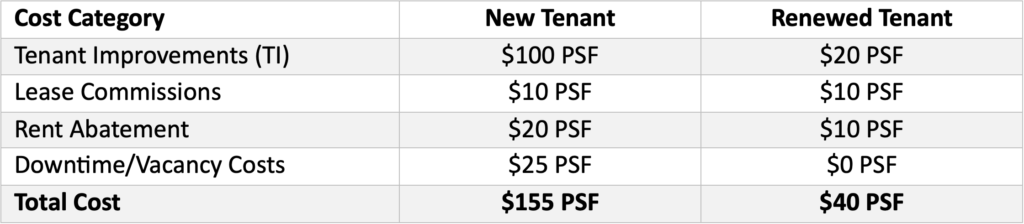

The following chart illustrates the financial impact of leasing a 10,000 square foot office space to a new tenant versus renewing the lease for an existing tenant for a 5-year term:

For a 10,000 square foot space:

- New Tenant Cost: $1,550,000

- Renewal Cost: $400,000

Renewing the existing tenant results in a cost savings of $1,150,000 over the lease term, demonstrating the financial benefits of tenant retention.

Why Tenant Retention Should Be a Strategic Priority

Property managers and owners who prioritize tenant retention can achieve significant long-term savings and operational stability. By focusing on the financial ramifications, it becomes clear why tenant retention should be at the forefront of any commercial real estate strategy.

Click here for Part 2, where we’ll explore actionable strategies to retain tenants and create a sense of community within your properties.